Merchant Doodle Payment Systems

SWFL Auto Repair Business Success Story

(SWFL) Ten (10) Years in Business – MORE MONEY TO SPEND Every Month using Cash Discount Payment Processing (+15K every year).

Jump on a Call?

- Started with Merchant Doodle in 2020

- Puts 15K+ back on their Bottom Line Annually

- Saves Thousands in Ongoing Fees

- New Cash Discount Merchant Processing Account, New Processing Equipment

- Saves Time with Local Concierge Customer Service (just a text, email, or phone call away)

For the last fifteen (15) years this Naples-based service and performance center has been smoothly building their auto import market-share by servicing BMWs of all makes and models. Whether its routine oil changes, major repairs, or extra add-on-type performance upgrades, this specialty shop is well-known and highly trusted among local area BMW owners all over SWFL. All of their work is backed by a 100% complete satisfaction guarantee, and they even provide a 12-month 12k mile warranty on all their services.

“In addition to specializing in custom BMW and import performance work, we constantly strive to provide our customers with a high-level of knowledgeable and friendly service.

But I had trouble getting access to my statements. After they helped us get our statements, they got our price comparison over to us pretty fast. At first, I really couldn’t believe the printout. I mean the regular credit card processing rate was pretty good, but all the extra money we have from using the Cash Discount program just blows me away!

And I really appreciate the time and effort that was spent educating me on the various different programs so I could make a good decision. It’s been great.

Where the Owners were coming from:

This specialty auto import and performance center needed more money to spend on their business, but the owner didn’t have the time to investigate all the available offerings from all the different service providers, because he was extremely busy running and growing his business.

Since he couldn’t do the research himself, he had to try to find someone he could trust. Several people had come into the shop over the years attempting to help, but he never felt comfortable with them because he never really felt like he understood what it was they were asking him to do.

Because no provider had ever come along that was willing to visit multiple times and spend the appointment time on-site educating the owner until he had all the facts and knowledge he needed to make a good decision, he was locked into a cycle of non-action. The business was still using an 11-pound-dinosaur credit card processing terminal from 2006 to accept payments. Their overall rate and fees were from 2006 as well. At Merchant Doodle, we still have a picture of that credit card machine in our office today (2021).

We use the picture of that 11-pound credit card machine as a constant reminder that our job is to educate business owners about what they’re currently paying, what options they have, and too clearly explain how Cash Discount and whatever other programs they’re interested in works (and what effects each program can have on their business and specifically their cash flow). We believe then and only then can the business owner make the best decision for their specific operation.

I would say to any business owner out there in SWFL today, you need to take a real look at Merchant Doodle’s Cash Discount Programs. Not all are compliant and not all are the same. Parts costs are going up, labor costs are rising, and you need to explore your options on this one. Merchant Doodle really has this together and they’ve done a fantastic job on this for us. We couldn’t be happier and I strongly recommend it to all business owners. You really owe it to yourself and your business to take a look at this one.”

In-House Success Notes:

After the first meeting the owner knew he wanted to see a real side-by-side cost analysis, so he said he would send his statements over in a day or two. After a few weeks Christy text-messaged the owner asking if he needed assistance getting his statements. He said he could use her help because he had been trying for two (2) full weeks to get his statements and wasn’t getting anywhere with his current provider (we run into this a lot). We helped him understand that a lot of business owners don’t have the time or always know the best process for gaining access to their merchant service portal (where their statements live).

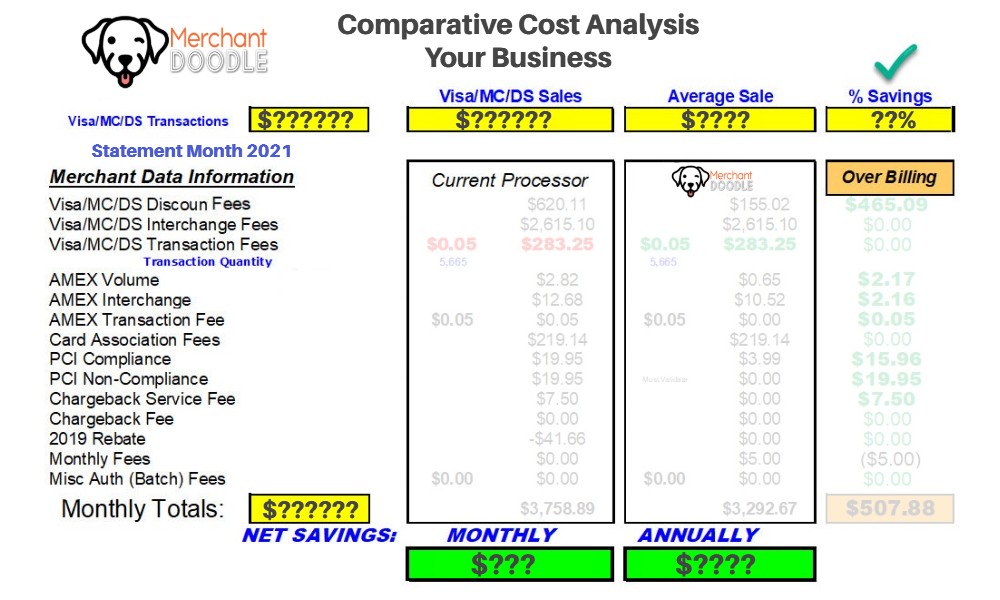

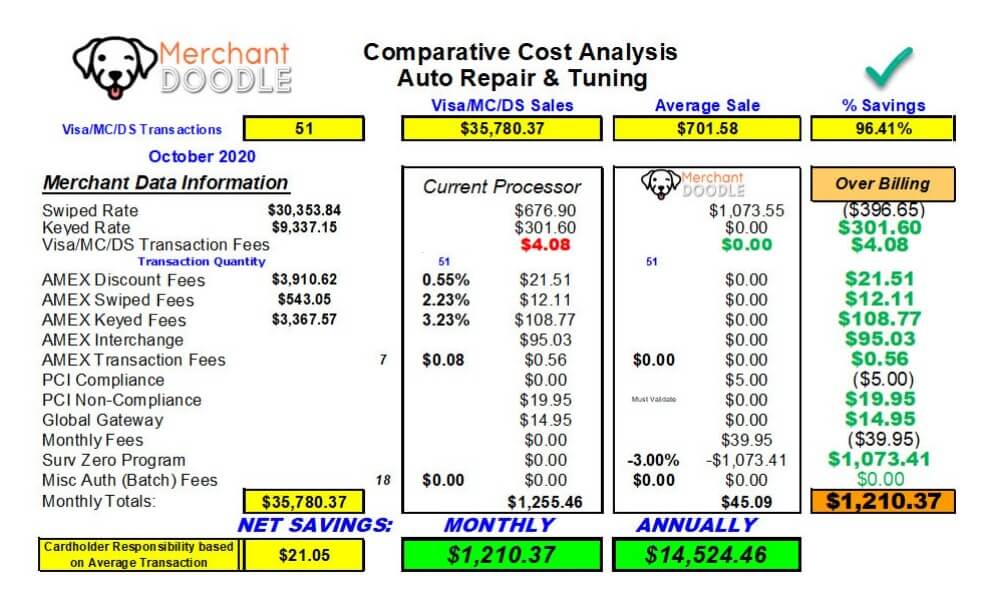

Once this owner understood that he was no longer alone and that getting access to credit card processing statements can sometimes be a messy and tricky process – he immediately authorized us to work on his behalf as his virtual assistants in order to gain access to his business statements online. We then provided the business owner with the cost analysis (a clear side-by-side and apples-to-apples comparison) of what he was currently paying, what options were available to him and his business, what effects each program would have, and a detailed explanation of the charges, fees, and savings that came with each program.

This business owner chose to use our 100% Compliant Cash Discount program and currently has access to more than $15,000 extra dollars to spend each and every year.

Statistically Speaking:

When talking to Business Owners everyday at Merchant Doodle, we hear a lot of reflexive responses like:

- We already have a great rate…

- We’re good with the bank…

- We’re happy with our setup…

Of course having 100s of local SWFL small-and-medium businesses as valued clients allows us the unique perspective that only comes from the real numbers and statistics which clearly tell us:

-

83% of all small businesses lose (and will continue losing) money on payment processing.

Fact: We routinely help clients keep 3-4k and sometimes 8-12k+ per year on traditional credit card processing. -

78% of business owners believe there is something special about processing thru their bank.

Fact: Most major banks (top 10) are referral partners with a major up-stream processor. are The only things special about it are Higher Rates and Slower Customer Service. -

71% of businesses do not have an efficiently optimized payment setup and checkout flow.

Fact:There is an entire consulting industry built around choosing POS and Payment solutions for businesses. Most don’t require that, but a little knowledge & guidance can go a long way.

Direct Q & A:

Q: What was the reason you switched from your original provider to Merchant Doodle?

A: Honestly, the money was big for us. We wanted a new smart terminal and better customer service, but we also needed to keep more money in the business. Merchant Doodle not only acted on my behalf to get access to my statements, but then provided us with both traditional and cash discount processing options. They clearly laid out the pros–and–cons of each approach and the money involved with each program. That impressed me because there was real money on the table no matter which option we went for! They took the time and really educated me and explained exactly how compliant cash discount worked. Now I know that not all cash discount setups are actually compliant in all states. After learning that we would only be passing a small percentage fee on to each customer, and that the credit card terminal would be setup to do it for us automatically, we decided to go for it. And it’s been great… absolutely fantastic!”

“I appreciated being educated about the 100% compliant cash discount program available to us in Florida. The change-over was very easy, and our clients all understood that doing this helps us maintain our current prices.”

Q: What goals did you hope to achieve by switching to Merchant Doodle?

A: By going with Merchant Doodle I started a relationship with people that have an active interest in my business and now I know my merchant processing is handled for me. They even handle the annual PCI compliance for me and I have access to unlimited paper. It’s just great.

“We’re keeping over $15,000 extra dollars in our business every year with Merchant Doodle!”

Q: How long have you been with Merchant Doodle?

A: We’ve been going for almost a year now and haven’t had a single issue. Our PCI compliance was recently handled for us and our new smart terminal never runs out of paper.

“They did what they promised me which was lower our costs of operations while saving us time.”

Merchant Doodle Facts:

Because it’s a large ongoing expense for all businesses (and we can usually make a huge difference) everything at Merchant Doodle starts with your payment processing.

At Merchant Doodle we believe that even though paying credit card processing fees is a necessary evil, you and your business shouldn’t have to pay more than what is fair for the amount of volume you process. It’s our duty and job to help SWFL business owners understand who you’re paying fees to, what you’re paying for, what service and type of services you should expect for what you pay.

At the end-of -the-day it’s all about keeping more of the hard-earned money your business brings in, so you have more money to spend on the things you and your business need.

We have discovered that most business owners don’t realize the following facts:

Payment transactions all go thru the same basic routing, processing, and/or gateways. These may include FirstData/FiServ, TSYS, Worldpay/FIS, Heartland/Global and a few others.

Almost all Top 10 Banks are just referral partners for one of the major acquirer processors. These may include FirstData/FiServ, TSYS, Worldpay/FIS, Heartland/Global, Evalon and a few others.

We all (payments providers) have the same access to these services. For instance, Merchant Doodle has the exact same accounts PNC offers. We offer Clover and a bunch of other POS Systems and Integrations just like the banks do (with much lower overhead & better service).

What you (as a business owner) are really choosing is your servicing partner. Everyone pays interchange to the major credit card issuers, but it’s the servicing partner (us) that takes care of you, your business, and any merchant account or processing issues that may come up.

We’re a certified Microsoft Partner, Google Partner, and offer excellent Cloud-based Payroll. We manage business social media accounts, SEO and paid ad campaigns across all online and social channels, and we provide enterprise email and graphic design services including business cards and logo design for all our clients.

Since the payment processing services are the same, it’s always better to choose a servicing partner with a local presence and lower overhead (which equals MORE MONEY in your pocket).

+We offer a lot of additional value along with concierge customer service and attention that can’t be matched by your bank.

This means that you’re more than just a number to us because we’re interested in you and your business. And taking action is as easy as calling us up today. We’re here and we’ll be glad to hear from you.